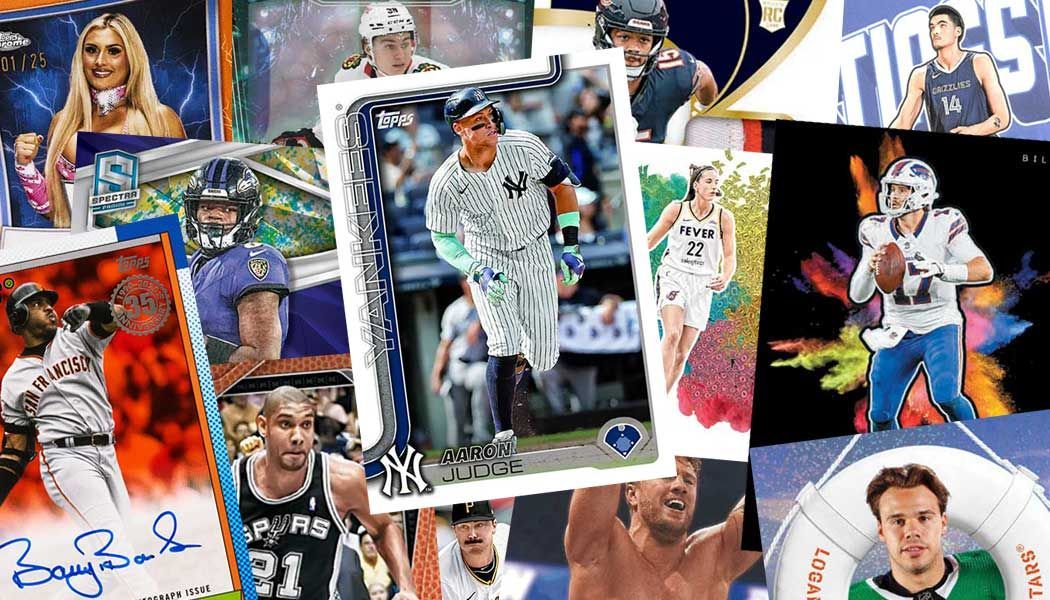

Card Financing Tips to Grow Your TCG & Sports Card Business 2025

How Financing Your Inventory Can Unlock Growth and Boost Your Collectible Card Business

For trading card and sports card collectors, resellers, and store owners, staying competitive means having the right inventory at the right time. But buying valuable cards or bulk inventory outright can tie up your cash flow and limit your ability to grow. That’s where card financing comes in — a funding strategy designed specifically to help you purchase inventory without draining your working capital.

What Is Card Financing?

Card financing is a type of loan or funding option that allows you to borrow money specifically to purchase trading cards, sports cards, or related collectibles. Instead of paying upfront in cash, you finance your inventory, spreading payments over time. This keeps your cash flow healthy and lets you invest in other areas of your business simultaneously.

Why Card Financing Is Worth It for Your Business

- Preserve Cash Flow: Instead of spending your entire budget on one purchase, financing helps you keep cash on hand for daily operations, marketing, or expansion.

- Buy More, Buy Better: With financing, you can afford larger lots or higher-value cards, which can boost your resale profits and attract serious collectors.

- Stay Competitive: Quickly act on rare finds or trending releases without waiting to save enough cash.

- Scale Faster: Financing gives you the ability to grow inventory quickly, expand your product offerings, and serve more customers.

- Flexible Terms: Many financing options come with flexible repayment schedules tailored to your business cycle.

How to Get Card Financing in 2025

- Know Your Business Needs: Assess how much inventory you want to finance and how much you can comfortably repay each month.

- Prepare Your Financial Documents: Lenders may ask for income statements, sales history, and business plans showing your card business potential.

- Compare Financing Options: From inventory loans to merchant cash advances, find the product that best fits your cash flow and growth plans.

- Work With Specialized Lenders: Some lenders understand the collectibles market better and can offer tailored financing solutions.

- Maintain Good Records: Keeping detailed sales and inventory records increases your credibility and improves your chances of approval.

Tips to Use Financing Wisely and Grow Your Card Business

- Invest in hot and trending card sets that move quickly

- Use financing to test new markets or expand your online presence

- Balance your financed inventory with organic sales to avoid over-leveraging

- Invest in marketing and events to increase your sales velocity

- Track your ROI to ensure financing is accelerating your profits

-

Need Financing With No Credit Impact? The Vault Netwrk Can Help

If you want to grow your trading card or sports card business with financing options that don’t hurt your credit, The Vault Netwrk is your partner. They offer a variety of loan and funding types tailored to your needs, helping you secure capital fast and scale your business smartly in 2025.