How TCG & Sports Card Collectors, Resellers, and Store Owners Can Get a Loan and Scale Their Business in 2025

How TCG and Sports Card Businesses Can Secure Funding and Scale Successfully in 2025

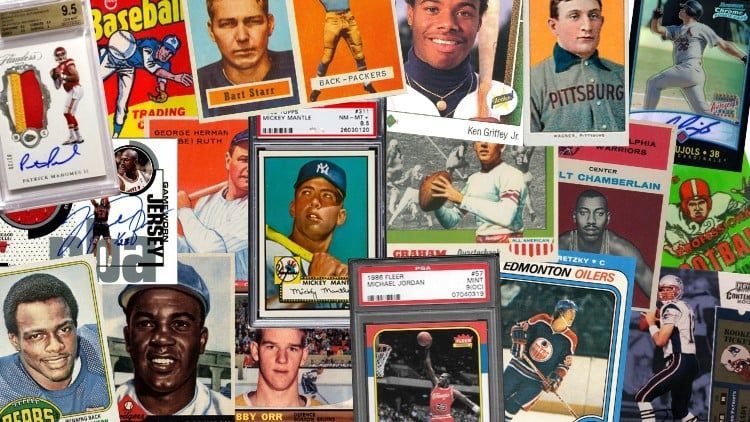

The trading card and sports card market continues to grow rapidly, with passionate collectors and savvy resellers turning their hobby into thriving businesses. Whether you run a local store, an online shop, or a reseller operation, having access to capital is key to scaling and staying competitive in 2025.

If you’re looking to grow your business, expand your inventory, or invest in marketing, understanding your loan options and business growth strategies can set you up for success. Here’s a guide on how TCG and sports card entrepreneurs like you can get funding and scale effectively this year.

Why Getting a Loan Can Be a Game-Changer for Your Card Business

Growing your card business often requires cash to:

- Purchase high-value or rare cards in bulk

- Stock up on trending or newly released card sets

- Invest in store renovations or expand your physical location

- Build out an e-commerce website or marketing campaigns

- Attend conventions, trade shows, or buy booth space

While organic growth is possible, loans can provide that financial boost to seize opportunities quickly without waiting to accumulate profits.

Types of Loans for TCG & Sports Card Businesses

There are several loan options available for collectors, resellers, and store owners:

- Small Business Loans: Traditional loans from banks or credit unions, typically requiring good credit and business history.

- Online Business Loans: Easier to qualify for, with faster approval but sometimes higher interest rates.

- Merchant Cash Advances: Advance funds based on future sales, suitable for businesses with consistent card sales.

- Inventory Financing: Loans specifically tied to purchasing inventory like cards or supplies.

- Personal Loans: For sole proprietors or side hustlers, but may have higher rates.

Many lenders offer loans with flexible terms, and some specialized lenders understand the niche market of collectibles and reselling.

Tips to Scale Your TCG & Sports Card Business in 2025

- Leverage Digital Platforms: Build or improve your online store. Use social media channels like Instagram, TikTok, and YouTube to showcase your inventory, unboxing videos, and customer testimonials.

- Build Community: Host local meetups, tournaments, or online groups to foster loyal customers and collectors.

- Diversify Inventory: Stay ahead by offering both popular and niche cards — including vintage, limited editions, and emerging card games.

- Offer Grading & Authentication Services: Partner with grading companies or offer consignment for graded cards to boost credibility and sales.

- Use Data Analytics: Track sales trends to know which cards are hot and manage inventory smartly.

- Attend Industry Events: Network at conventions and expos to find suppliers, buyers, and business partners.

- Optimize Customer Experience: Fast shipping, excellent packaging, and responsive service can turn buyers into repeat customers.

How to Prepare for a Loan Application

- Organize your financials: income statements, expenses, and inventory value

- Prepare a simple business plan explaining how you’ll use the funds to grow

- Know your credit score, but don’t worry if it’s not perfect—some lenders offer options regardless

- Gather your business licenses and legal documents if applicable

- Be ready to explain your business model and sales channels

The Vault Netwrk Can Help Fund Your Growth with No Impact to Credit

If you’re ready to take your TCG or sports card business to the next level but worried about the loan process, The Vault Netwrk is here to help. They specialize in providing flexible funding solutions tailored to collectors, resellers, and store owners like you.

With access to all types of loans and funding options — and the best part, no impact on your credit — The Vault Netwrk makes it easier than ever to secure the capital you need to scale your business in 2025.

Ready to grow your card empire? Reach out to The Vault Netwrk today and explore how they can support your journey with the right funding, personalized to your business needs.