How Collectors & Resellers Can Use Loans to Scale Faster in 2025

How Collectors & Resellers Can Use Loans to Scale Faster in 2025

How to Get a Loan as a Collectibles Investor or Reseller: Smart Funding Strategies to Scale Faster

Why Collectors and Resellers Should Think Like Investors

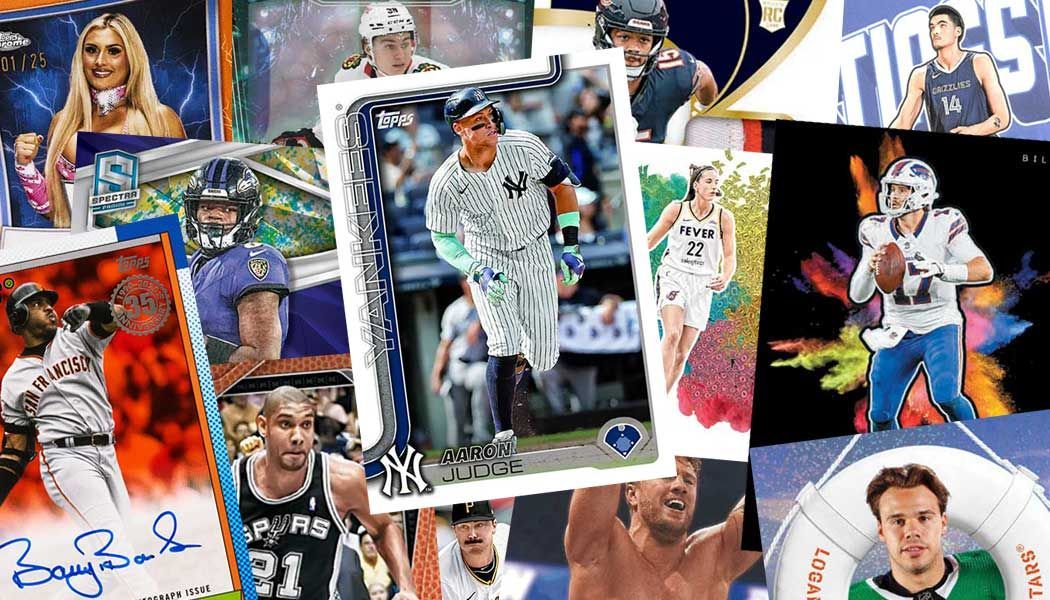

The collectibles industry—whether it’s sports cards, Pokémon cards, comics, or rare memorabilia—has exploded in recent years. What was once considered just a hobby is now a multi-billion-dollar market where collectors and resellers are building real businesses.

But here’s the reality: scaling a collectibles business takes money. Whether you’re buying into upcoming card releases, rare auctions, or preorders, having access to fast capital can be the difference between getting ahead of the competition—or watching valuable opportunities pass you by.

That’s where funding comes in. Getting a loan, private funding, or partnering with an investment group isn’t just about covering expenses—it’s a growth strategy that allows you to buy smarter, sell faster, and maximize profits.

Why Funding Makes Sense for Collectibles Investors

Unlike traditional businesses, collectibles investors face unique challenges:

- High Upfront Costs – Rare cards, sealed boxes, or vintage collections can cost thousands upfront.

- Fast-Moving Markets – Preorders and limited releases sell out within minutes.

- Competitive Auctions – If you don’t have cash available, you’ll get outbid.

- Scaling Inventory – The more stock you can secure, the faster you can flip or hold for long-term gains.

By securing business loans, private funding, or working with investment partners, you unlock a strategic advantage:

- Buy collections in bulk at discounted rates.

- Secure preorder allocations before prices spike.

- Compete in auctions with confidence.

- Scale your eBay, WhatNot, or marketplace store faster.

How to Get a Loan as a Collectibles Investor or Reseller

Here are a few proven funding paths for collectors and resellers:

1. Traditional Business Loans

Some banks and credit unions are beginning to recognize the legitimacy of the collectibles market. However, they often require strong credit, detailed business plans, and consistent revenue history.

2. Alternative Lenders & Online Loans

Platforms that specialize in small business lending may be more flexible. While rates can be higher, they’re often faster and easier to access than banks.

3. Private Investors & Investment Groups

This is one of the most underrated funding options in the collectibles space. Private investors are looking to back businesses with high growth potential. As a collectibles investor, you have a unique advantage: your business is tied to tangible assets (cards, memorabilia, comics) that hold or even increase in value over time.

Partnering with private investors can provide you with capital, mentorship, and growth connections.

Why Private Funding is Often Smarter

Banks look at collectibles as “risky” and often undervalue them. Private investors and funding groups, however, understand the market and the growth opportunity.

With private backing:

- You get funding faster with fewer hoops.

- Investors may take on some risk with you, instead of rejecting you.

- You can often access more capital than traditional loans allow.

This isn’t just about borrowing money—it’s about building a partnership that accelerates your business growth.

What's Next

The collectibles market in 2025 and beyond is only getting hotter. From sports cards and Pokémon to limited edition preorders, the opportunities are endless—but only for those with capital ready to deploy.

If you’ve been thinking about how to scale your collection or reselling business, don’t limit yourself to just what’s in your bank account. Explore loans, private investors, and funding groups that can give you the competitive edge you need.

The smartest collectors aren’t just buying cards—they’re building businesses. And every successful business is built on strategy, timing, and funding.

✅ Pro Tip: If traditional banks won’t back you, consider pitching to a private investment group. Many are actively looking to fund small businesses in collectibles, reselling, and alternative assets. All it takes is a solid 60-second pitch to show why you’re a good fit.